As deadlines for Avondale deal loom, Port of South Louisiana scrambles to line up advisors

Leaders of the Port of South Louisiana are in the unusual situation of trying to determine whether a potentially transformative acquisition of the former Avondale shipyards site makes any financial Port of South Louisiana is in the unusual situation of trying to determine whether a potentially transformative acquisition of the former Avondale shipyards site makes any financial sense after they already agreed to a price. Paul Matthews, executive director of the port, confirmed he had negotiated the $445 million sale directly with the T. Parker Host team, led by CEO Adam Anderson, last June when he was just six months into the job as the port’s CEO. The experts that have been hired so far to advise the port did not come on until after the port's board gave Matthews approval to sign the deal in January. The port has yet to hire anyone for a feasibility study, though the “due diligence” period for the agreement ends on Friday. If the port doesn’t seek another extension, port officials would have to complete the transaction by June 29 or face the loss of its $1.5 million deposit – plus up to $500,000 to cover Host's costs. The deal could be in the hands of the Bond Commission when the bond issue comes up for approval. However, some business and political leaders have expressed doubts from the outset about the price tag, including Gov. John Bel Edwards.

Được phát hành : một năm trước qua ANTHONY MCAULEY and SAM KARLIN | Staff writers trong

Leaders of the Port of South Louisiana are in the unusual situation of trying to determine whether a potentially transformative acquisition of the former Avondale shipyards site makes any financial sense after they already agreed to a price. Paul Matthews, executive director of the port, confirmed he had negotiated the $445 million sale directly with the T. Parker Host team, led by CEO Adam Anderson, last June when he was just six months into the job as the port’s CEO, and before he had engaged any outside financial advisors. The experts that have been hired so far to advise the port – bond counsel Foley & Judell; Government Consultants Inc.; and underwriters Wells Fargo and Stifel, and Piper & Sandler – did not come on until after the port’s board gave Matthews approval to sign the deal in January. Foley & Judell advised the port last month to hire experts to do a feasibility study to see if the deal makes financial sense. The port has yet to hire anyone for that study, though the “due diligence” period for the agreement ends on Friday, having already been extended by a month. If the port doesn’t seek another extension, port officials would have to complete the transaction by June 29 or face the loss of its $1.5 million deposit – plus up to $500,000 to cover Host’s costs. That would be a painful penalty for the port, which made $3.7 million in net profit last year. The port could avoid losing its deposit if the deal falls through because it fails to raise the financing. That decision will be in the hands of the Bond Commission when the bond issue comes up for approval.

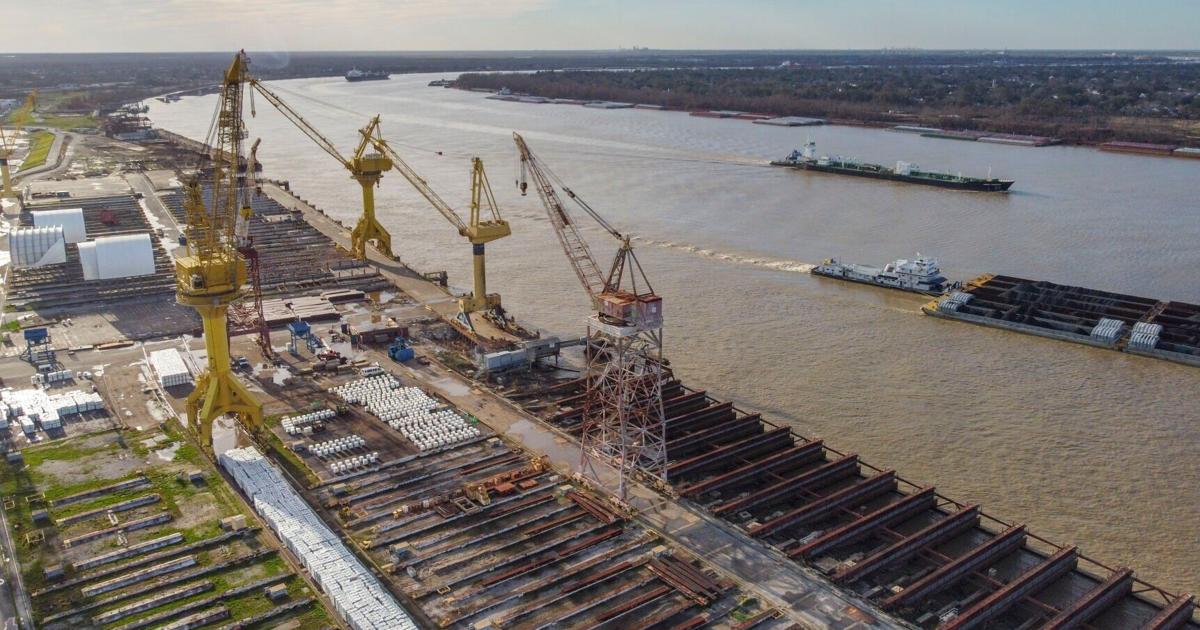

Matthews said in an interview with The Times-Picayune that he is prepared to end the deal if the numbers don’t pan out. “We said we’re going to follow the process and follow our experts to see where it leads at the end of the day,” Matthews said. “If the math doesn’t work, it doesn’t work. We move on.” But Matthews, 39, who was tapped to lead the Port of South Louisiana after serving as the No. 2 at the Plaquemines Port, said he remains optimistic about the deal. "You miss 100% of the shots you don't take," he said, quoting hockey great Wayne Gretzky. The shipyard was once one of the state's largest employers, building vessels for the U.S. Navy and others for nearly 100 years. But the last ship rolled off its docks more than a decade ago. What was left on the 254-acre site has required millions of dollars in environmental remediation and still will need substantial capital. While the Port of South Louisiana’s objective of maximizing the site's potential got a warm reception, a range of business and political leaders expressed doubts from the outset about the $445 million price tag. The skeptics have included Gov. John Bel Edwards, a key member of the Bond Commission. Henry “Tut” Kinney, a New Orleans-based lawyer who has worked on major port and infrastructure deals, has tracked the proposed Avondale deal closely. He said he cannot see how it could pass muster with the Bond Commission given the terms that have been made public. “There are no hard financial data that would support the purchase price or the repayment of the debt,” Kinney said. “In my opinion, it would be virtually impossible to pass the scrutiny of the Bond Commission.” According to the agreement signed by Matthews, the Port of South Louisiana agreed to pay T. Parker Host the lesser of $500 million or the value of a subsequent third-party appraisal, which pegged the asset's value at $445 million. That appraisal, conducted by Baton Rouge firm Cook, Moore, Davenport & Associates, was based on bullish projections of Avondale’s potential income over the next eight years, which were calculated from financial data that largely came from T. Parker Host.

The appraisal assumed that net income at the site would nearly triple from about $14 million this year to more than $40 million by 2030. That forecast assumes T. Parker Host, who would continue to manage the site, would be able to attract significantly more tenants than it has to date. The port and T. Parker Host have declined to release any of Avondale’s financial data or information about current clients, saying it is commercially sensitive, but they have yet to sign an anchor tenant. But even accepting that tenant income will grow as forecast, financial experts said it is difficult to see how it would cover the debt obligations. "Based upon the publicly available information at this time, this project is not feasible," said Harold Asher, a forensic accountant at Asher Meyers. “The money that the project will generate won't come close to paying the interest at any point in time. This project needs to be re-worked and perhaps structured with financial incentives to the seller based upon the performance of the port." Some observers are more optimistic. Gary LaGrange, an ally of Matthews and a former Port Nola head, argued in support of the Avondale purchase in a recent opinion column published in The Times-Picayune. "The port as a state entity will give Avondale the ability to access infrastructure dollars from Washington and Baton Rouge," he wrote. "Equally as important, it will provide for a ‘team’ approach in global marketing led by the port, the state and regional and local marketing entities that few privately held groups could compete with." In the interview, Matthews said that he would welcome the Port of New Orleans as a partner both to help finance the deal and as an investor to ensure its future success. The appraisal detailed how any purchaser would need to invest at least another $21.5 million to bring two additional docks into use to realize Avondale’s potential as a manufacturing center and logistics hub and to meet the forecast revenue growth.

Though Avondale is within the Port of New Orleans’ jurisdiction, the city port’s officials were not consulted before the deal was announced. They had previously studied Avondale and were considering buying it before Huntington Ingalls sold the property to T. Parker Host for $60 million in 2018. Matthews said he'd love to bring the Port of New Orleans into the fold, suggesting a joint deal could be on the table in the future. He said it’s a conversation he “can’t wait to have” with Port Nola executives. Port Nola’s CEO, Brandy Christian, said they would like to be involved in Avondale’s future development, but would not take part in any deal based on the terms the Port of South Louisiana has agreed to. “We would welcome the opportunity to be a part of Avondale’s future development, but it is not financially feasible under the terms of the current deal,” Christian said. “We would first need to complete our own financial, engineering and environmental due diligence to determine the level of investment needed to identify a path forward for Avondale and to ensure sustainable success for Jefferson Parish and the region, while limiting financial risks to the public,” she added.

• June 10, 2022: Port of South Louisiana Director Paul Matthews signs letter of intent to buy Avondale from T. Parker Host for up to $500 million.

• August 2022: Appraiser hired by Port of South Louisiana pegs the value of the site at $445 million.

• January 9, 2023: Port of South Louisiana Board immediately votes to approve the deal and hire bond counsel.

• Jan 10, 2023: Paul Matthews signs purchase and sale agreement with Host for $445 million.

• Matthews and Host agree to amend the deal to extend the due diligence deadline.

• February 6, 2023: The port’s bond counsel asks the port to hire a “feasibility consultant” to analyze the deal.

• None New deadline for due diligence period. After this point, the port will be on the hook for larger termination penalties. If the deadline isn’t extended, the port must close by June 29.

Chủ đề: Louisiana